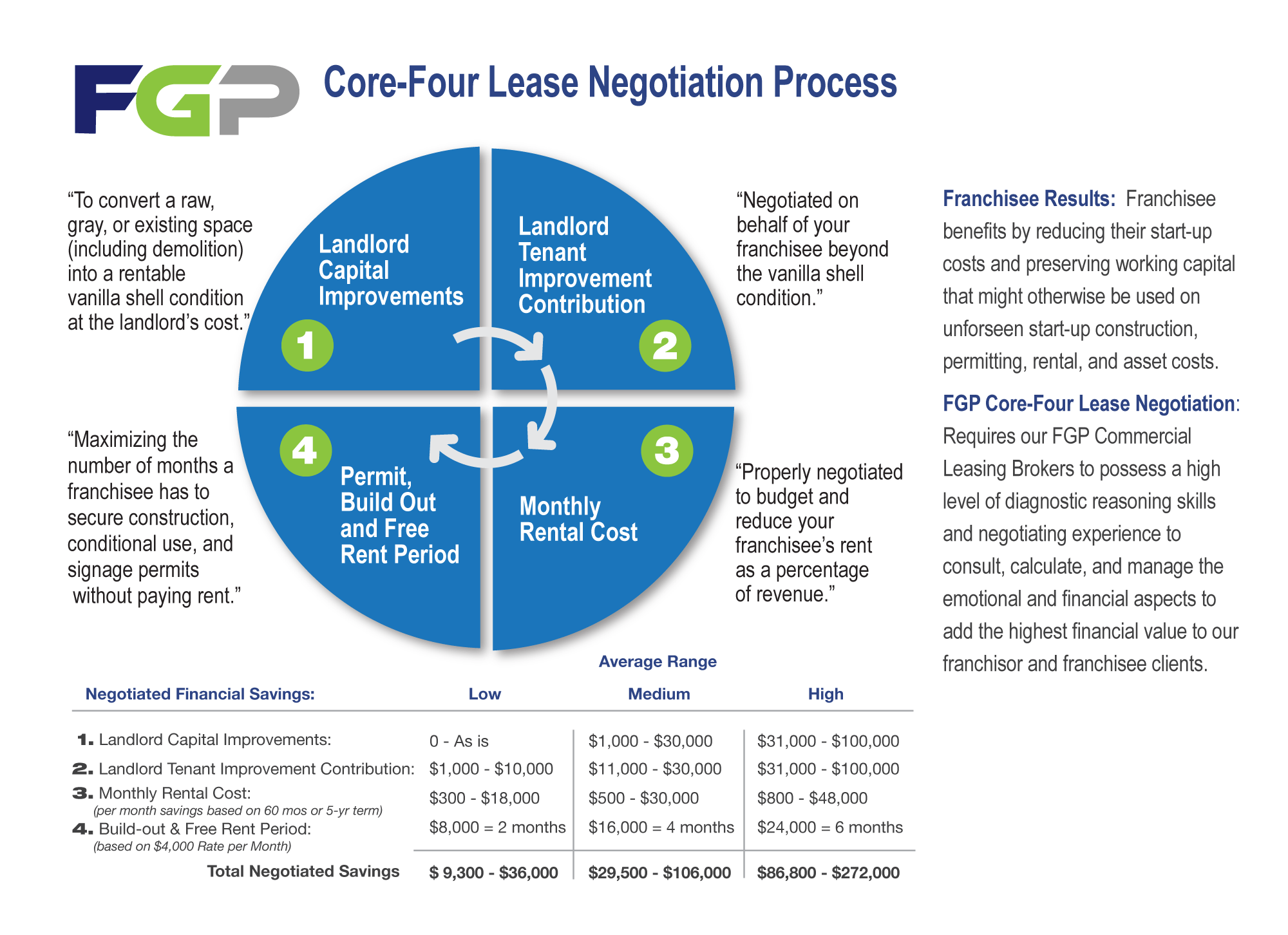

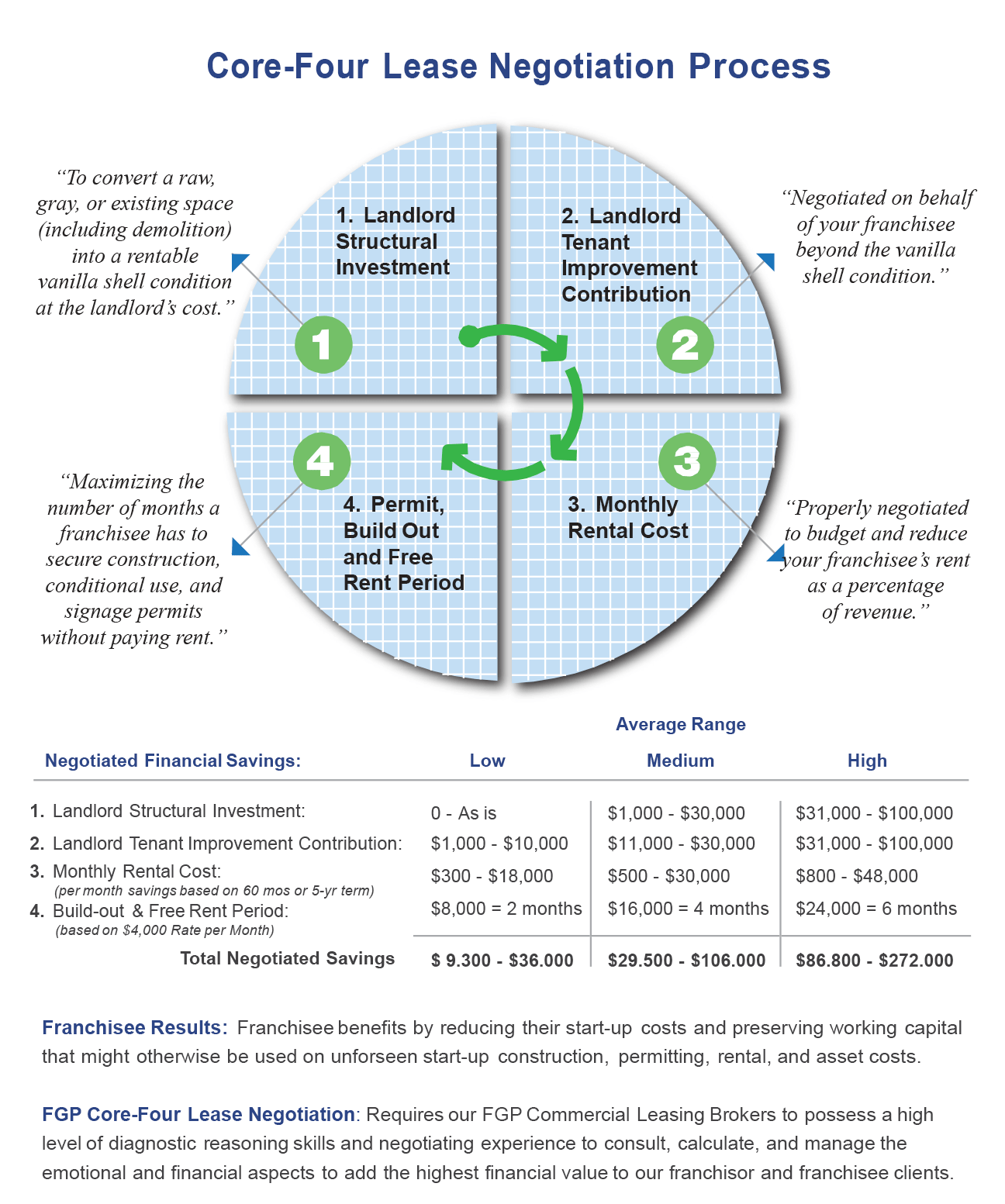

The Core-Four Lease Negotiation Process

Keys to reducing start-up costs, preserving working capital and protecting franchisee profitability.

YOU’VE HEARD THE OLD phrase “location, location, location.” The real truth is “location, condition and cost.” Location affects the visibility, customer traffic and gross revenue. The condition of the property affects low-to-high start-up costs and protects budgeted working capital. Cost represents the monthly rent as a percentage of revenue and the profit/loss of your franchisee’s business.

Before a franchisor can begin to improve its overall lease negotiation systems, there must be an honest appraisal of the current lease negotiation practices. The following two questions will assist you in this appraisal.

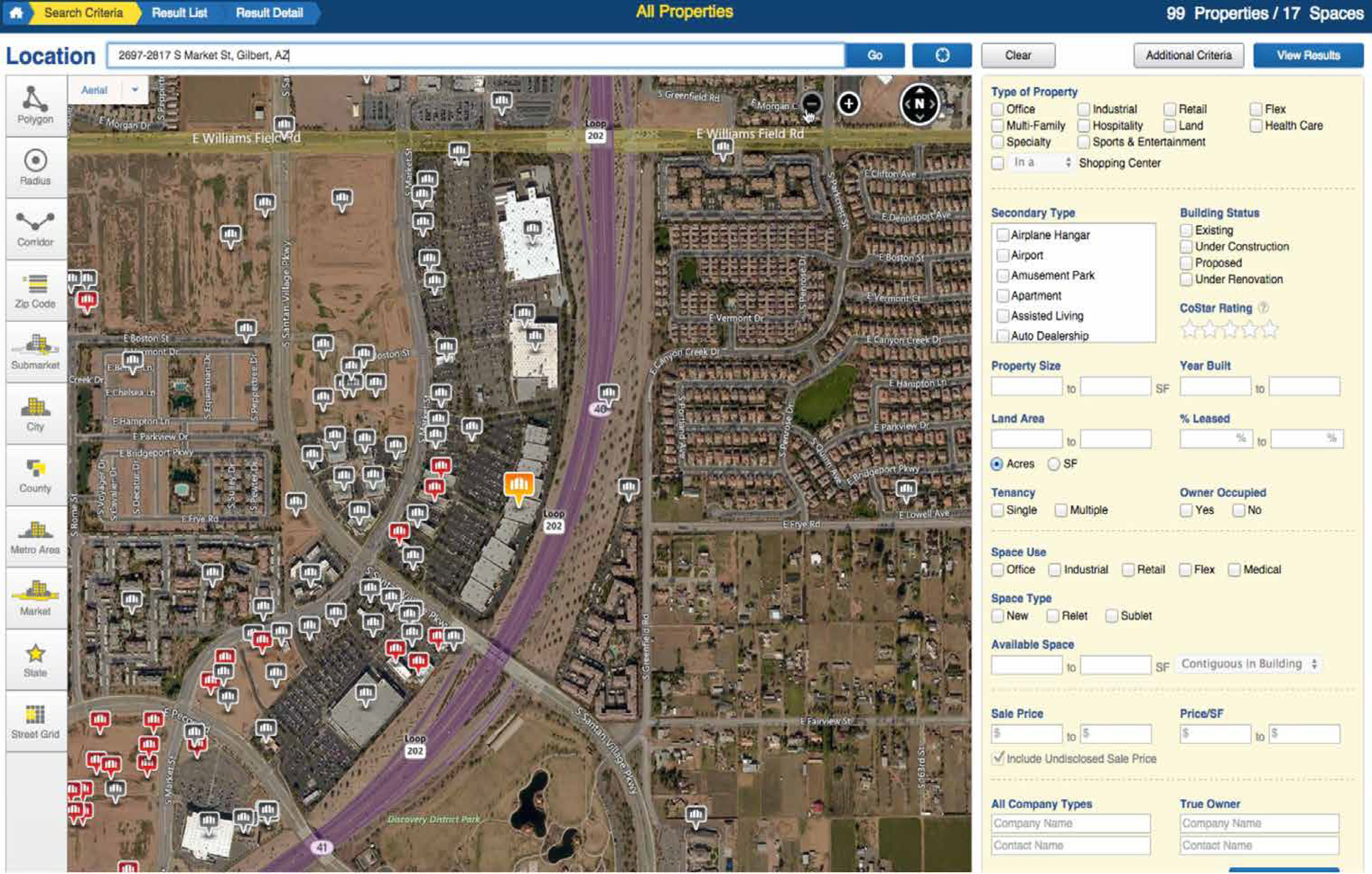

- Do you know in which specific rural, medium, metro- or major-metropolitan markets your next 20 franchises will be sold?

If the answer is “no,” your franchise system will be dependent on 20 different negotiating commercial agents or brokers, each representing a different franchisee on a market-by-market basis. Regardless of the real estate firm size to represent your local franchisee, it is the individual broker’s experience that generates the most profitable outcome for your franchisee. If you as a franchisor have assigned multiple brokers in your past 20 locations, the next question you will need to ask is this:

- Have these regional or state-by-state brokers been “Navy SEAL” trained on every detail of your industry segment, concept and unit-level business model? This includes site selection, lease negotiation, franchise agreement addendums, landlord legal review, permitting and the construction management process.

If the answer is “no,” there is a major gap between your franchisor expectations, broker negotiation quality and the desired results that franchisees expect and deserve. Your franchisees don’t know what they don’t know and legitimately assume that their assigned broker has been highly vetted and interviewed on their level of lease negotiation expertise. In fact, a franchisor may utilize a variety of brokers in different states, with varying experience in negotiations.

Generally, the results of the core-four financial quadrants will be up to 50 percent less than the franchisors’ and franchisees’ potential level of financial savings.

LANDLORD STRUCTURAL INVESTMENT

Commercial leasing agents representing local franchisees will often take shortcuts, because they can, and because the franchisor has not implemented strict guidelines or procedures in the lease negotiation process. Local, regional and institutional landlords are allowed by brokers to sidestep up to 50 percent of their financial responsibilities to pay for demolition, raw, gray, or vanilla shell investments that return the property to a rentable condition.

LANDLORD TENANT IMPROVEMENT CONTRIBUTION

Because of the shortcuts taken by these brokers, which franchisors and franchisees seldom identify due to the geographical distance, lack of supervision and franchisees’ inexperience, tenant improvement dollars are not maximized on behalf of your franchisee. This can cause your franchisees’ start-up costs to increase dramatically. If this is multiplied over 20 new franchise locations per year, it can represent millions of dollars of additional costs for your franchise system. This creates an overall franchisee experience of investing more than they expected to open up their business. This situation can be avoided by improved lease negotiation techniques, systems and processes that are implemented at the appropriate time for each new franchisee location.

MONTHLY RENTAL COST

We performed an independent system-wide audit on monthly rent and triple-net lease as a percentage of revenue. We were not shocked to find a weighted average of more than 15 percent monthly rent-to-sales ratio. Our audit concluded that there was a series of poor real estate strategies in combination with multiple regional and state-by-state real estate brokers that were inexperienced and untrained by the franchisor. The franchisor assumed that by outsourcing their real estate sites, they would eliminate these weaker and lower level lease negotiations.

DUE DILIGENCE, PERMITTING AND ENTITLEMENTS

The most secretly used strategy utilized by local brokers is harnessing shortcuts to quickly get leases executed without protecting the franchisor and franchisee. It is necessary to understand the permitting process of local municipalities including time, cost, forms and factors, which contribute to the time it takes to secure the required conditional use permits. These broker-induced shortcuts can cause major delays, legal issues and added costs. As a result, franchisees may be paying premature monthly rent over several months even though the business is not yet in operation.

The core-four financial quadrants discussed earlier each require separate financial goals and high-level negotiation skill sets. They are interrelated and will substantially reduce your franchisees’ start-up costs, accelerate the breakeven points, protect early working capital and, most importantly, result in a monthly rental cost which protects the low and high franchisee revenues and profitability. High-performing locations and operators with a lower rent-to-sales ratio do not feel the financial pain of a poorly negotiated lease.

LEASE PROVISIONS

- Lease Term

- Security Deposit (Refundable)

- Rental Abatement

- Permit Contingencies

- Eight Early Termination Clauses

- Broker Commission

- Rental Rates

- Renewal Terms

- Tenant Improvements

- Common Area Maintenance/Triple Net Lease

- Corporate Signature

- Parking Allowance

- Franchisor Addendum

- Personal Guarantee

- Lease Extension

- Sublease Assignment

- Signage Regulations

- Exclusivity

When negotiating a lease, most franchisees focus on the rent as their primary issue. However, the basic or minimum rent paid by a franchisee is just one of the many costs and risks under a lease that must be understood and carefully negotiated. In fact, the numerous provisions listed above can exceed the risk and expense of basic rental costs, if they are not properly negotiated at the outset.

A competent real estate broker will be generally knowledgeable with these provisions. However, it is our experience that only the very best can provide a thorough explanation of both the landlord and franchisee considerations when negotiating a commercial lease.

Check this: Understanding Male Enhancement Products: A Comprehensive Guide